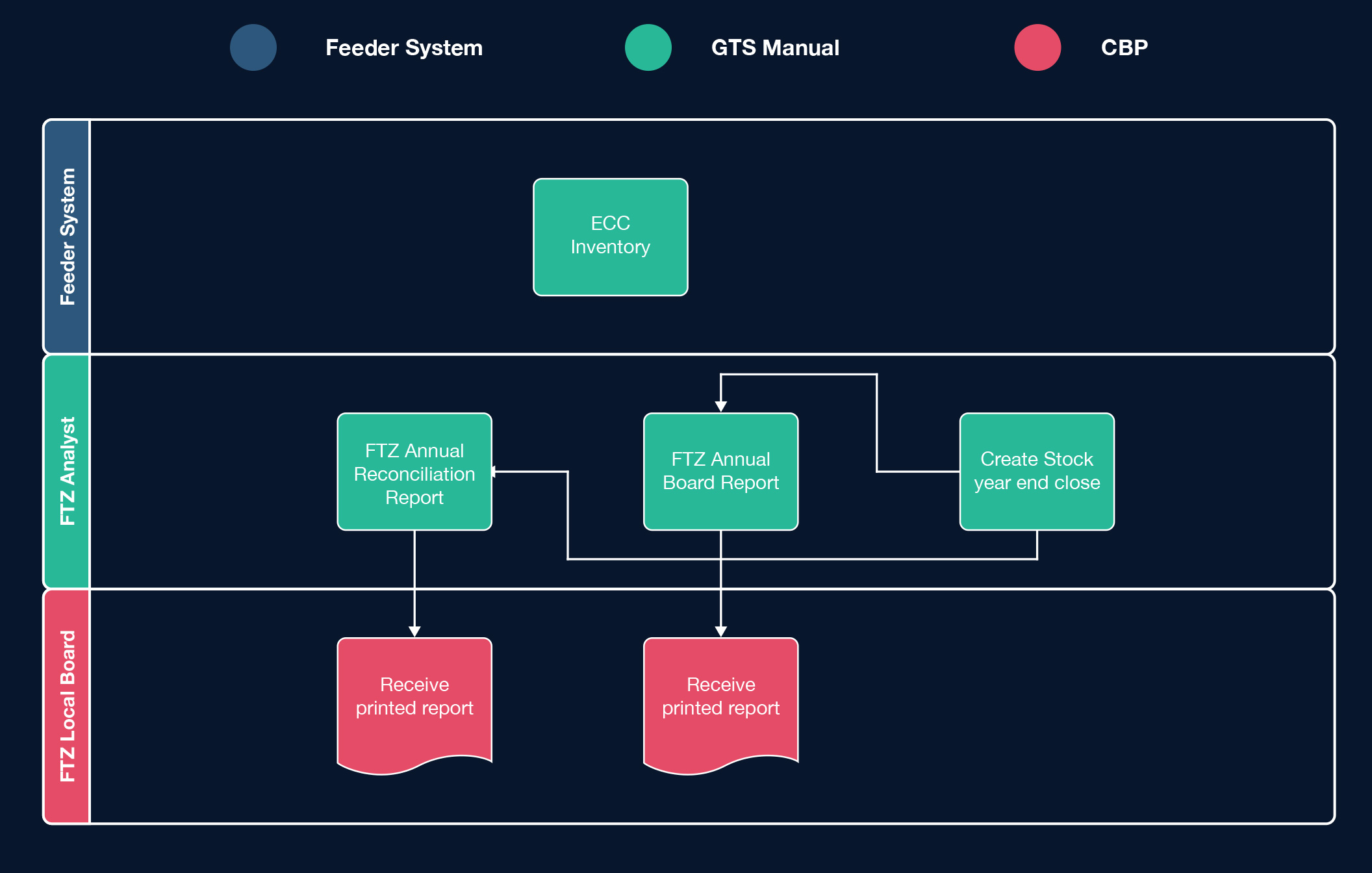

As a US FTZ owner/operator, aside from the day-to-day obligations of inventory controls, filing of admissions and weekly entries there are some annual requirements as well. In this white paper, we will explain the regulatory obligations as well as the reports available from SAP Global Trade Services to meet those requirements.

All US FTZ operators need to submit a report to their grantee (if they operate as a subzone) and the grantee’s need to submit it to the board by March 31st. This typically means preparing the report sometime in February. All board reports need to be filed into the Online FTZ Information System (OFIS). The annual board report is a comprehensive report of all activities that occurred in the zone each year. It includes the beginning and ending values, merchandise admitted, and entered into commerce. Any merchandise exported, sent to other zones, or destroyed need to be accounted for as well.

CFR Title 19, Chapter 146.25 lays out the requirement for FTZ operators to prepare a reconciliation report within 90 days after the end of zone/subzone year. This report needs to be prepared, completed, and reviewed. More importantly, it does not need to be filed with CBP. The stipulation is merely to prepare the report and make it available if requested by CBP. However, what is required is a signed letter to the port director within 10 days certifying that the report is prepared, complete and accurate. Any gains or losses discovered as a part of the reconciliation process need to be reflected by filing CBP 214s and CBPF 3461/7501 respectively. This is also the time to consider prior notifications or voluntary disclosures for qualifying discrepancies.

The year-end closing process in SAP GTS FTZ (Global Trade Services - Free Trade Zone) involves a series of activities and steps to finalize and reconcile the operations and transactions conducted within a Free Trade Zone (FTZ) at the end of a fiscal year. This process ensures accurate reporting, compliance with regulatory requirements, and proper recordkeeping for the FTZ activities.

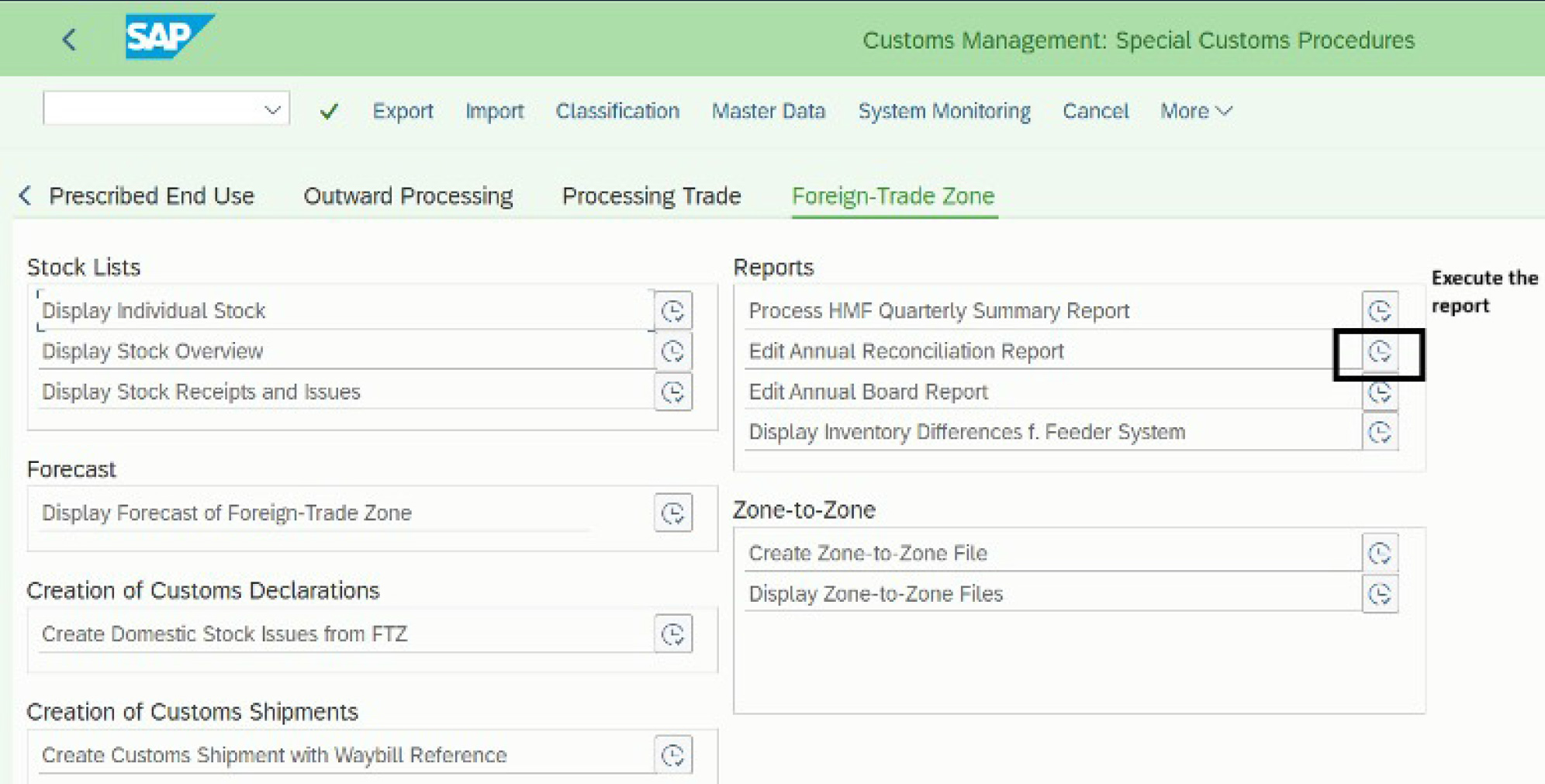

To create the Annual Board Report and Annual Reconciliation Report, enter the transaction /SAPSLL/FTZ_YRCLS Create Stock Year-End Close in the command line.

Enter the relevant customs ID, FTZ posting year, and quarter, then choose Execute to create a stock year-end close.

The system determines all data required to create the two-year end reports

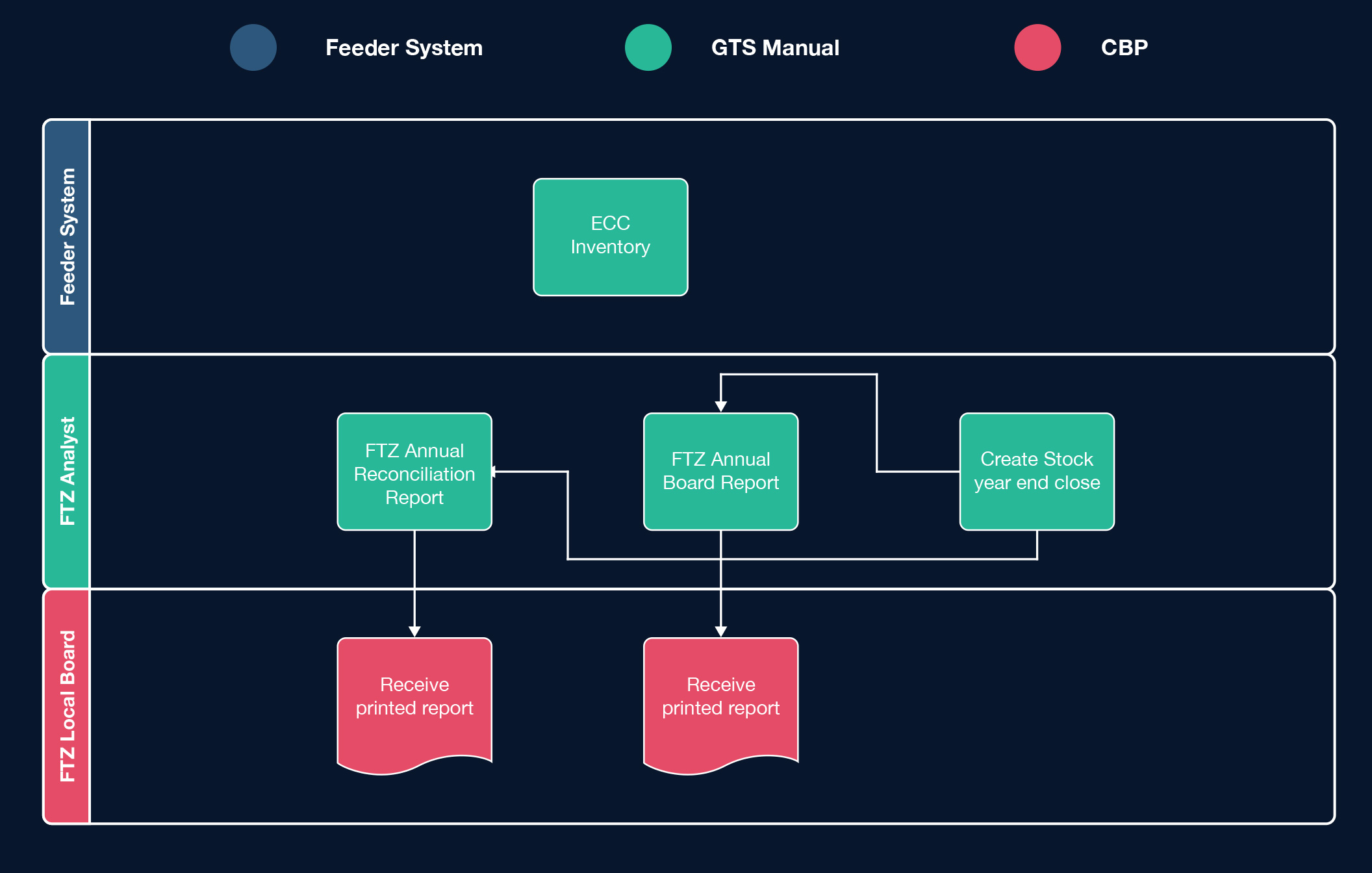

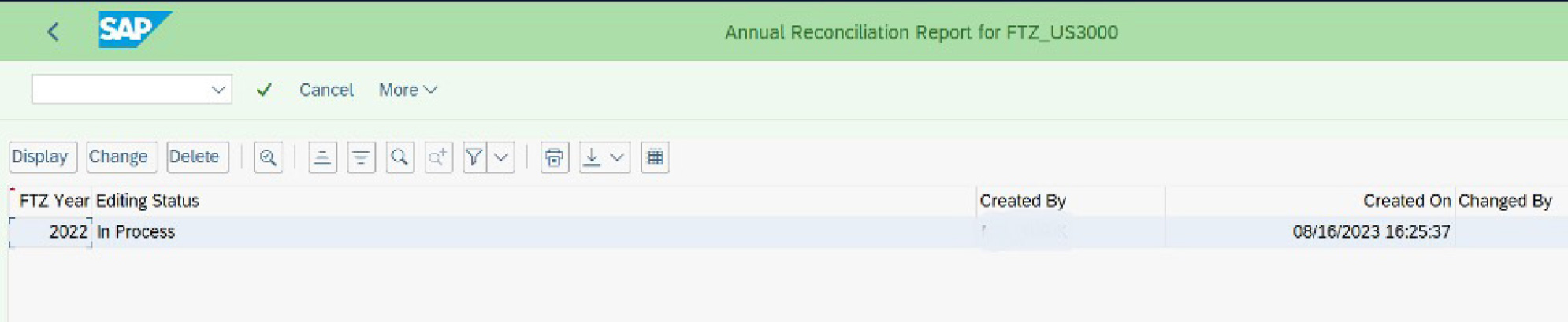

If the report was already created for the year, the data is overwritten if the processing status is “In Process”.

Then call transactions /SAPSLL/FTZ_ANRCN and /SAPSLL/FTZ_ANBRPT to have the annual reconciliation report and annual board report displayed.

The administrator can execute the Perform Year-End Closing program for the current year as often as required. The previously determined data for the same selection criteria is updated when the processing status in the Annual Board Reports or in the Annual Reconciliation Reports is set to In Processing.

The program determines the data for the corresponding posting year that the Annual Board Report and Annual Reconciliation Report used as a data foundation and is stored in tables /SAPSLL/FTZANBRPT

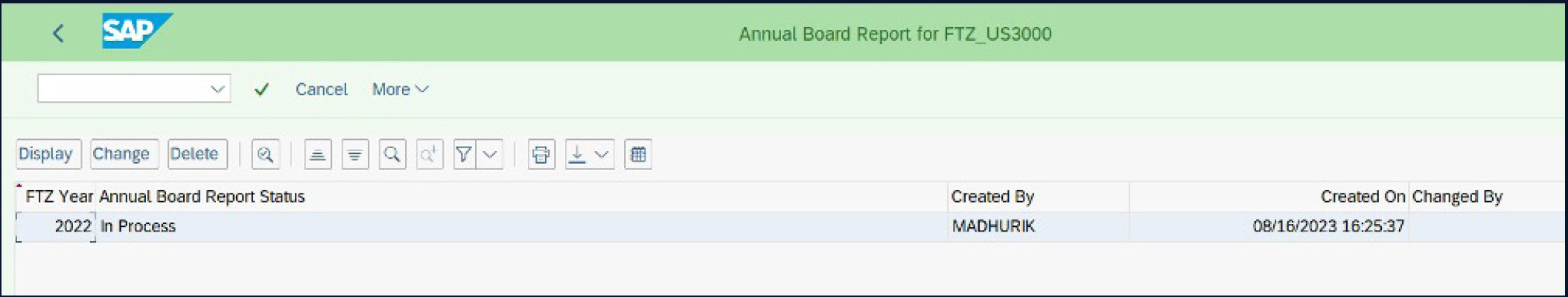

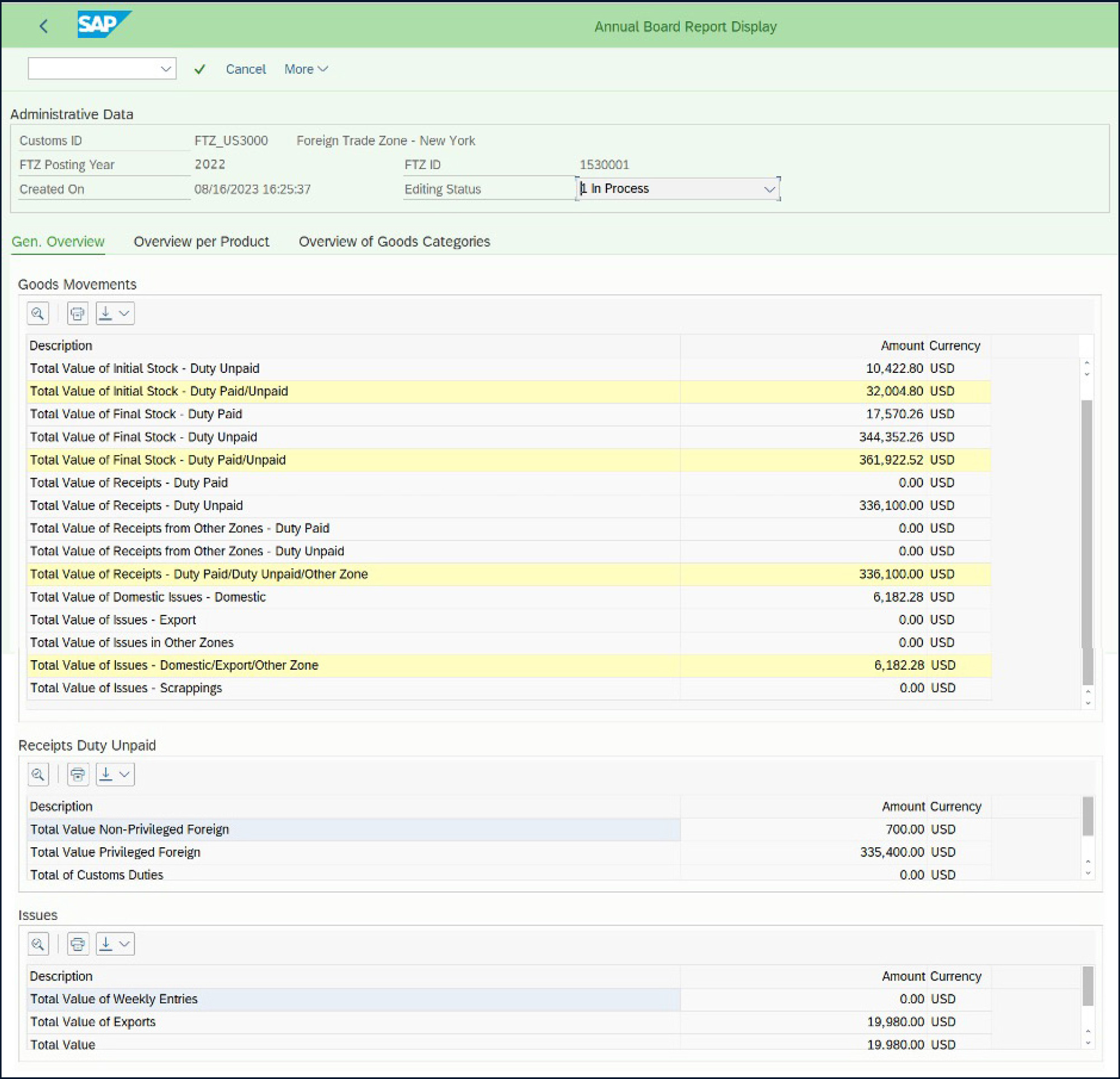

The Annual Board Report is a critical aspect of managing Free Trade Zone (FTZ) operations, as it provides a comprehensive overview of a company’s activities within the FTZ. SAP Global Trade Services (GTS) FTZ offers a robust solution to streamline and automate the Annual Board Report process, enabling companies to efficiently compile, analyze, and report on their FTZ operations

Transaction code /SAPSLL/FTZ_ANBRPT displays the annual board report generated for all years in a foreign trade zone

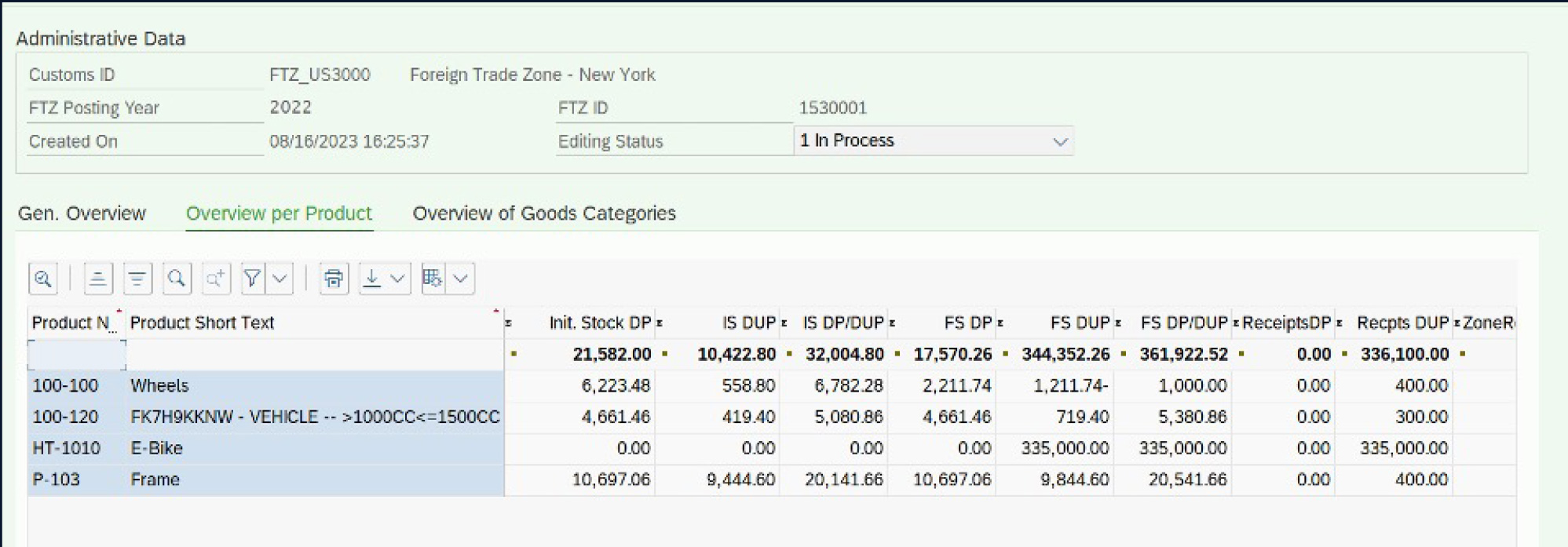

The overview tab lists all goods movements and the value of duty paid/ unpaid stock issues and receipts within a FTZ.

It shows you a detailed view of the value of goods movements for each product such as the Initial stock duty paid/unpaid , final stock duty paid/unpaid with total value of receipts duty paid/unpaid , total value exports and imports etc.

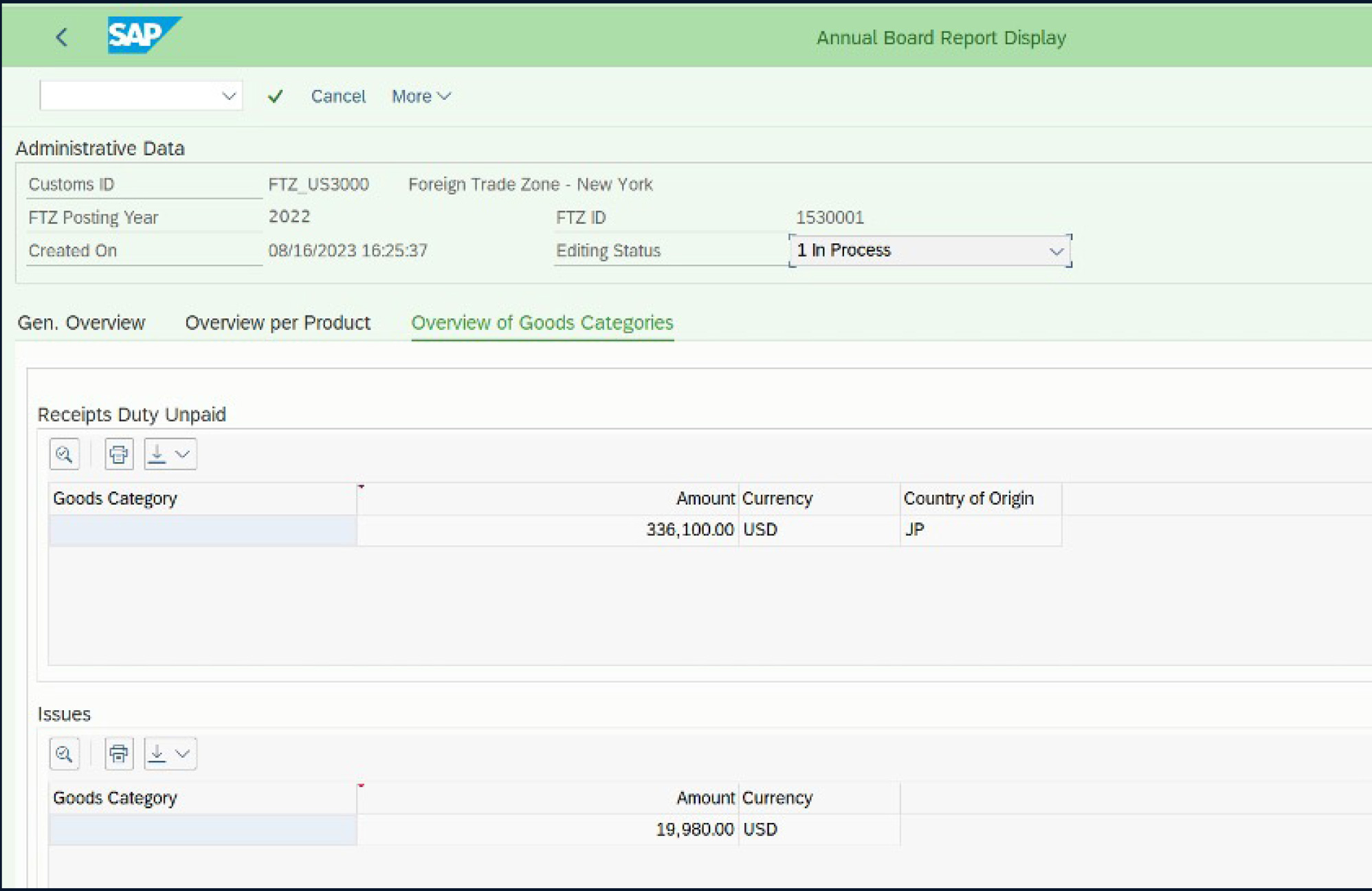

Displays the top 5 goods issues and goods receipts duty unpaid values with their country of origin.

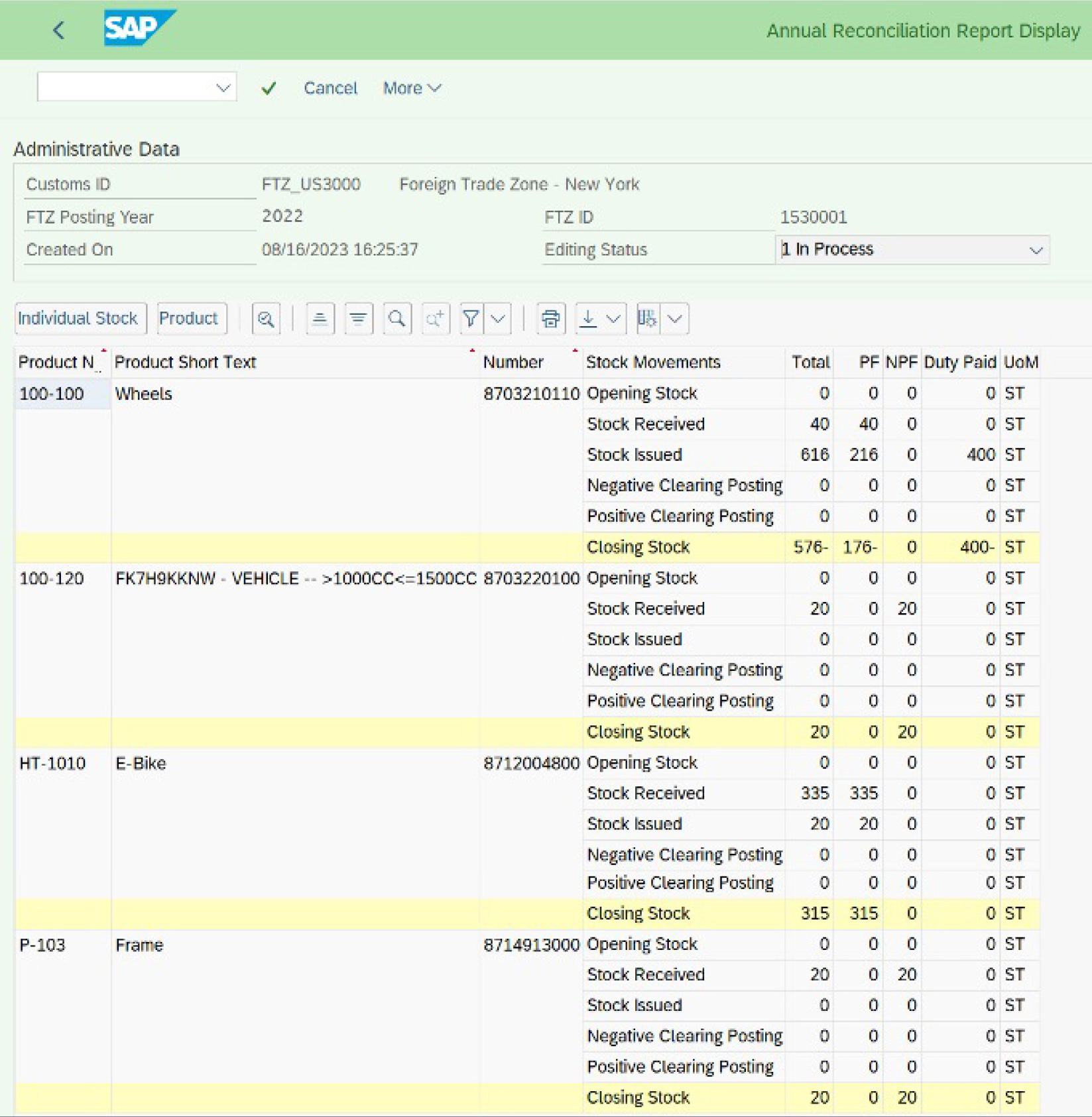

In the context of SAP GTS FTZ (SAP Global Trade Services - Free Trade Zone), the term “Annual Reconciliation Report” refers to a comprehensive report that summarizes and reconciles the activities and transactions conducted within a Free Trade Zone (FTZ) over the course of a fiscal year. The purpose of the Annual Reconciliation Report is to provide a consolidated view of all FTZ-related operations and inventory movements for a specific period, typically a year.

Most companies prefer to generate the report monthly for finance monthly review to get an overview of the duty owed for FTZ and also to make necessary corrections/adjustments in case of inventory discrepancies between feeder system and GTS

It provides insights into the company’s FTZ operations, inventory levels, and trends, helping management make informed decisions and optimize FTZ processes

It helps ensure compliance with regulatory requirements and customs regulations by providing a detailed record of all FTZ transactions and activities

The report may be submitted to local FTZ boards or other regulatory bodies as part of compliance obligations.

The report serves as an audit trail that can be used for internal and external audits, enabling authorities to verify the accuracy and legitimacy of FTZ operations.

Details of the Opening stock balance and Closing inventory balances for each product within the FTZ.

A breakdown of goods admitted to and issues from the FTZ during the fiscal year, including quantities, values, and customs duties paid.

Reconciliation of the quantities of goods admitted, removed, and remaining in the FTZ to ensure accuracy and compliance.

Benefits of operating within an FTZ are accompanied by onerous recordkeeping and compliance requirements. SAP Global Trade Services US FTZ solution aims to make the annual closing and reporting requirements as painless as possible by generating required reports out of the box. Close integration with ERP and Warehouse Management functions allows for tracing discrepancies easily and taking corrective actions.